Under Section 146 of the Motor Vehicles Act, 1988 (amended)

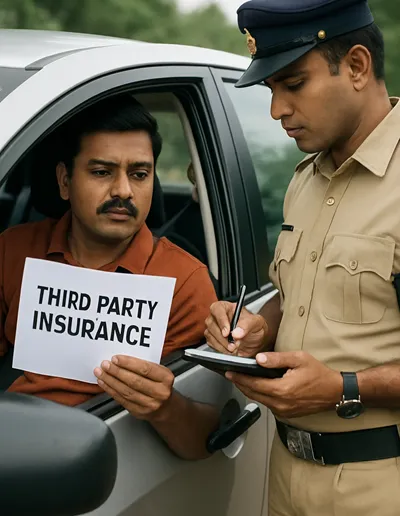

Third-party insurance is compulsory for all vehicles in India—cars, bikes, scooters, trucks, buses, autos, etc. No one can legally drive a vehicle on public roads without it.

This rule exists to protect innocent accident victims by ensuring they receive compensation without waiting years in court.

Key Features of Third-Party Insurance

- Mandatory for every registered vehicle (private & commercial).

- Covers injury, death, or property damage caused to another person.

- Does not cover damage to the owner's vehicle.

- Penalty for driving without it → First offence - ₹2,000 fine or up to 3 months jail, subsequent offence - ₹4,000 or up to three months jail

- Premium rates are fixed by IRDAI (uniform across India).

- New vehicles: Must buy long-term third-party insurance (3 years for bikes, 5 years for cars).

Where to Get Third-Party Insurance Quickly

Online (Fastest Option)

- Insurance company websites (SBI General, LIC, ICICI Lombard, HDFC Ergo, Bajaj Allianz, etc.).

- Insurance aggregator platforms (Policybazaar, Coverfox, Digit, Acko, etc.).

- VAHAN Portal (https://vahan.parivahan.gov.in/) – check status & link with RTO.

Time taken: 5–10 minutes (digital policy issued instantly by email/SMS).

Offline

- RTO counters (insurance helpdesks at most RTOs).

- Authorized insurance agents.

- Bank or insurance company branches.

Time taken: 1–2 hours (depends on queue).

Documents Required

- Vehicle Registration Certificate (RC)

- ID Proof (Aadhaar, PAN, Voter ID, DL)

- Old insurance copy (for renewal)

- Passport-size photo (sometimes)

State-wise: Where to Buy/Check Third-Party Insurance

| State/UT | Where to Buy | Online Availability |

|---|---|---|

| Delhi | RTO counters, insurance agents, insurer websites | ✅ Yes (VAHAN + insurers) |

| Maharashtra | RTO, banks, insurers | ✅ Yes |

| Uttar Pradesh | RTO counters, agents | ✅ Yes |

| Tamil Nadu | RTO insurance desk, agents | ✅ Yes |

| Karnataka | Banks, RTO, insurers | ✅ Yes |

| West Bengal | RTO, insurance agents | ✅ Yes |

| Kerala | Insurance desks at RTO, agents | ✅ Yes |

| Gujarat | RTO & agents | ✅ Yes |

| Rajasthan | Banks, insurers, RTO counters | ✅ Yes |

| Other States/UTs | Same process as above | ✅ Yes |

In simple words: Every state allows both offline (RTO/agent) and online purchases.

FAQs on Third-Party Insurance

-

1. What is third-party insurance?

-

Insurance that covers liability for injury, death, or property damage to others caused by your vehicle.

-

2. Is it compulsory in India?

-

Yes. All registered vehicles must have at least third-party insurance.

-

3. What if I drive without it?

-

First offence - ₹2,000 fine or up to 3 months jail, subsequent offence - ₹4,000 or up to three months jail

-

4. Does it cover my vehicle's damage?

-

No. It only covers others' losses, not your car/bike.

-

5. Can I buy a new car without insurance?

-

No. A new vehicle cannot be delivered without a valid third-party policy.

-

6. What is the validity?

-

- 1 year (old vehicles).

- 3 years (new bikes).

- 5 years (new cars).

-

7. Who decides the premium?

-

The IRDAI. Rates are same across India.

-

8. Where can I buy it fast?

-

Online (insurance websites, VAHAN, aggregators) → instant policy.

-

9. What documents do I need?

-

RC, ID proof, old policy copy (if renewal), photo (sometimes).

-

10. Can it be bought online instantly?

-

Yes, within 5–10 minutes, the e-policy is emailed.

-

11. What if my friend drives my car and causes an accident?

-

The owner is liable, but the insurer pays if policy is valid.

-

12. Can insurers deny giving me third-party cover?

-

No. By law, they must provide it if papers are correct.

-

13. How to check my insurance status?

-

On VAHAN portal or insurer's website/app.

-

14. Do I need it if my vehicle is rarely used?

-

Yes. All registered vehicles must have insurance.

-

15. How does it protect me legally?

-

It saves you from paying heavy compensation personally and gives legal cover.

Add new comment