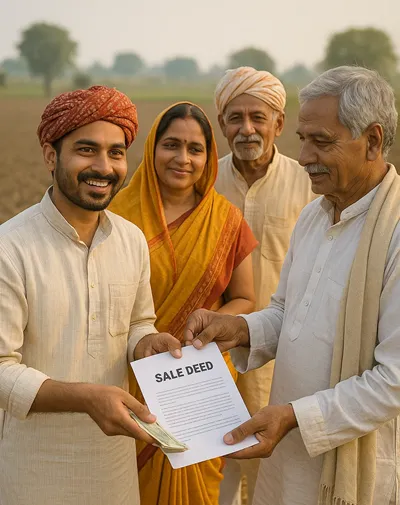

The Transfer of Property Act, 1882 lays down how ownership or interest in property can be transferred legally between living persons in India. It ensures that every transaction — whether it's a sale, gift, lease, mortgage, or exchange — is valid, voluntary, and legally enforceable.

Key Highlights

| Category | Details |

|---|---|

| Applies To | Voluntary transfers between living persons (inter vivos) |

| Main Focus | Immovable property (land, houses, buildings) |

| Who Can Transfer | A person who is an adult, of sound mind, and legally owns or is authorized to transfer |

| Who Can Receive | Any living person, including minors (but minors cannot transfer property themselves) |

| Mode of Transfer | Must be in writing, duly stamped, and registered (as required under Registration Act) |

Common Types of Property Transfers

| Type | What It Means | Consideration (Payment) | Registration Required? | Example |

|---|---|---|---|---|

| Sale | Full ownership transferred permanently | Yes | Yes | Selling a plot for ₹10 lakh |

| Gift | Ownership transferred voluntarily without money | No | Yes | Gifting a flat to a child |

| Lease | Right to use property for fixed time | Rent | Yes (if more than 12 months) | Renting a shop for 3 years |

| Mortgage | Property used as loan security | No sale money | Yes | Using your house to get a bank loan |

| Exchange | Properties swapped between owners | Both give & take | Yes | Two people swap their lands |

State-Wise Stamp Duty Snapshot (2025)

(Approximate – Refer to respective state registration portal for latest rates.)

| State | Sale Deed | Gift Deed | Lease (12+ months) | Mortgage |

|---|---|---|---|---|

| Delhi | 4% (women) / 6% (men) | ₹100–₹500 + 1% duty | 2% | 2% |

| Maharashtra |

5% + 1% (male) (Mumbai) 4% base + 1% metro cess (female |

₹200 + 3% | 1% | 2% |

| Uttar Pradesh | 7% for male and 6% for female | 2% | 2% | 2% |

| Tamil Nadu | 7% + 4% | 1% | 1% | 1% |

| Karnataka | 5%, 3%, 2% | 2% | 1% | 0.5–1% |

Tip: Check your state's Inspector General of Registration or Revenue Department website (ending with .gov.in or .nic.in) for updated rates.

Real-Life Insights

- Verbal transfers don't work for land or buildings.

- Stamp duty and registration are mandatory — without them, your ownership isn't legally complete.

- Power of Attorney sales are risky — valid only if registered and specific, not for bypassing sale deeds.

- Future property (something you may acquire later) can't be transferred today.

- Possession without registration is protected only under the Doctrine of Part Performance, and even that's limited.

Frequently Asked Questions (FAQs)

-

1. What does "transfer of property" mean?

-

It means legally giving ownership, possession, or rights in a property to another living person.

-

2. Can a minor transfer property?

-

No, but property can be transferred to a minor under guardianship.

-

3. Is registration compulsory for every transfer?

-

Yes, for all immovable property except leases under 12 months.

-

4. Can a property be gifted without money?

-

Yes. But it must be in writing, signed, attested, and registered.

-

5. What if I transfer a property I don't legally own?

-

The transfer is void — only lawful owners can transfer property.

-

6. Is oral transfer valid?

-

Only for movable assets. For immovable property, registration is essential.

-

7. What is a conditional transfer?

-

A transfer is valid only if certain conditions are fulfilled — e.g., "I transfer this flat if you marry before 30."

-

8. Can future property be transferred?

-

No. You can only transfer existing property.

-

9. Can someone transfer property to himself and another person jointly?

-

Yes, that's valid.

-

10. What is the "Doctrine of Part Performance"?

-

If you paid money and took possession but registration is pending, courts can protect your right from being unfairly denied.

-

11. What if my property buyer doesn't register the deed?

-

Ownership legally remains with you until registration.

-

12. Can a lease be made for 99 years?

-

Yes, but it's legally treated like long-term possession and must be registered.

-

13. Can a gift be cancelled later?

-

No — except if the gift deed itself allows revocation under specific conditions.

-

14. Is stamp duty the same in every state?

-

No. Each state government sets its own rates.

-

15. Is notarization enough?

-

No. Notarisation doesn't equal registration — both serve different purposes.

-

16. Can a registered transfer be challenged?

-

Yes, only on grounds of fraud, misrepresentation, or coercion.

-

17. Can I transfer ancestral property?

-

Only your share can be transferred. The rest belongs to other heirs.

-

18. Can an NRI transfer property in India?

-

Yes, through registered documents and following FEMA rules.

-

19. Is Power of Attorney sale valid?

-

Yes, but only if it's registered and specific and not used to avoid paying stamp duty.

-

20. Where can I verify my property registration?

-

On your state's Registration Department website (e.g., igrmaharashtra.gov.in, igrdelhi.gov.in, tnreginet.gov.in).

Add new comment