In India, as of 2025, data over 1.8 million private limited companies have been registered. A Private Limited Company (Pvt Ltd) is the most popular form of business entity in India. It gives limited liability, a separate legal identity, and better credibility for funding and contracts. Registration is completely online under the Ministry of Corporate Affairs (MCA) at www.mca.gov.in.

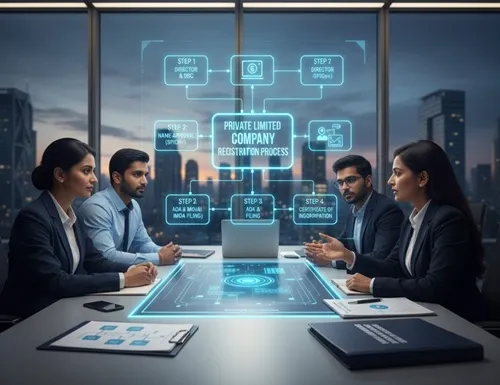

Step-by-Step Process to Register a Private Limited Company

1. Obtain Digital Signature Certificate (DSC)

- Required for all proposed directors and shareholders.

- Used to digitally sign the incorporation forms on the MCA portal.

Where to Apply: Any MCA-approved Certifying Authority (e.g., eMudhra, NIC).

Documents Needed:

- PAN card

- Aadhaar card

- Email & mobile number

- Passport-size photo

Fee: ₹1,000–₹2,000 per DSC (valid for 2 years).

2. Apply for Director Identification Number (DIN)

- Mandatory for every director.

- Can be applied directly through the SPICe+ (INC-32) form during incorporation.

- No separate application is required unless the person is not part of the new company.

3. Name Reservation

- Apply via SPICe+ Part A on the MCA Portal.

- Name must be unique and end with "Private Limited".

- Can propose up to 2 names per application.

Fee: ₹1,000 for name reservation.

Validity: 20 days once approved.

Tip: Avoid words like "National", "Bank", "Exchange", or government-related terms without approval.

4. Draft Incorporation Documents

Prepare the following mandatory documents:

- Memorandum of Association (MoA) – defines the company's objectives.

- Articles of Association (AoA) – defines rules and management structure.

- Declaration of Directors (Form INC-9).

- Consent of Directors (Form DIR-2).

- Proof of Registered Office – rent agreement or ownership proof + NOC from owner.

5. File SPICe+ (INC-32) Form

Single integrated form that covers:

- Incorporation

- PAN & TAN

- DIN

- EPFO, ESIC, and Professional Tax (where applicable)

Upload signed forms using DSC through the MCA portal.

Registrar of Companies (RoC) will verify details.

6. Receive Certificate of Incorporation (COI)

- Issued by the Registrar of Companies (RoC) via email.

- Contains Corporate Identification Number (CIN).

- The company legally comes into existence from this date.

7. Open Bank Account

- Use COI, PAN, and AoA/MoA.

- Banks require board resolutions and KYC of directors/shareholders.

Documents Required

| Category | Documents Required |

|---|---|

| Directors/Shareholders | PAN card, Aadhaar card, passport (for foreign nationals), latest utility bill, passport-size photo |

| Registered Office | Rent agreement or ownership proof, NOC from owner, latest electricity/water bill |

| Company Documents | MoA, AoA, Declaration (INC-9), Consent (DIR-2), Proof of Capital contribution |

| Others | DSC, DIN, Identity proofs, and address verification documents |

Key Eligibility Criteria

| Requirement | Details |

|---|---|

| Minimum Shareholders | 2 |

| Maximum Shareholders | 200 |

| Minimum Directors | 2 (1 must be resident in India for ≥182 days) |

| Minimum Capital | No minimum capital required (can start with ₹1) |

| Registered Office | Must be in India; can be residential or commercial |

Fees & Government Charges

| Component | Approx. Cost (₹) |

|---|---|

| DSC (per person) | 1,000–2,000 |

| Name reservation | 1,000 |

| SPICe+ filing (including PAN/TAN) | Included in MCA fees |

| Stamp duty (varies by state & capital) | ₹1,000–₹10,000 |

| Professional fees (CA/CS optional) | ₹5,000–₹10,000 |

| Total estimated cost | ₹7,000–₹15,000 |

Frequently Asked Questions (FAQs)

-

Q1. How many people are needed to start a private limited company?

-

Minimum 2 shareholders and 2 directors.

-

Q2. Can one person start it?

-

No, but you can start a One Person Company (OPC) instead.

-

Q3. Is a physical office mandatory?

-

Yes, a registered office in India is compulsory.

-

Q4. How long does registration take?

-

Usually 7–15 working days, depending on document verification.

-

Q5. Can foreign nationals be directors?

-

Yes, but one director must be a resident Indian.

-

Q6. Is GST registration included automatically?

-

No, it must be applied for separately on the GST portal.

-

Q7. Can a salaried person be a director?

-

Yes, unless their employment contract prohibits it.

-

Q8. Is a company secretary needed?

-

Not mandatory for small or new private limited companies.

-

Q9. What happens if the proposed name is rejected?

-

You can reapply with alternative names through SPICe+ Part A.

-

Q10. Can I register without a CA or CS?

-

Yes, but professional assistance is recommended to avoid form errors.

-

Q11. What is a CIN?

-

Corporate Identification Number, a unique ID given by the RoC.

-

Q12. Can the name be changed later?

-

Yes, through Form INC-24 after RoC approval.

-

Q13. What if my registered office is rented?

-

You need a rent agreement and NOC from the landlord.

-

Q14. Is there a government fee exemption for startups?

-

Some states offer stamp duty waivers for registered startups under DPIIT.

-

Q15. What is the role of MoA and AoA?

-

MoA defines the company's goals; AoA defines its management rules.

-

Q16. Are PAN & TAN issued automatically?

-

Yes, both are generated with the Certificate of Incorporation.

-

Q17. Can I change directors later?

-

Yes, using Form DIR-12 via the MCA portal.

-

Q18. Is registration valid forever?

-

Yes, as long as the company files annual returns and complies with MCA norms.

-

Q19. What happens if annual filings are not done?

-

Company may become inactive or struck off by the RoC.

-

Q20. Can I open a bank account immediately after registration?

-

Yes, with the COI, PAN, and board resolution.

Add new comment