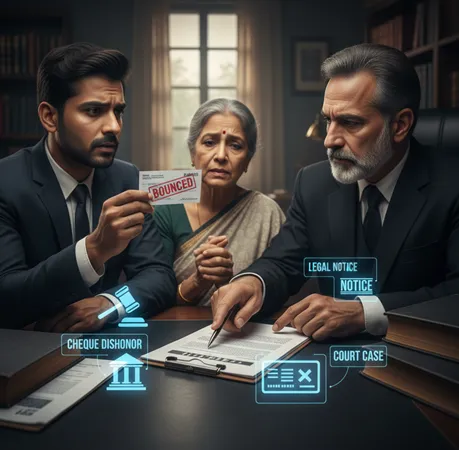

When you issue a cheque and the bank refuses due to insufficient funds or signature mismatch etc., that's a dishonoured cheque, commonly called a cheque bounce. In India, this can trigger criminal liability under Section 138 of the Negotiable Instruments Act, 1881.

Legal Steps After a Cheque Bounces

- Obtain the Bank Memo / Return Memo

The bank gives you a memo stating the cause for non-payment. - Send Legal Notice (Demand Notice)

Within 30 days from receiving the memo. It must demand payment of the cheque amount. - Wait for 15 Days

The drawer has 15 days to comply with the demand. - File Complaint

If payment is not made, you can file a criminal complaint under Section 138 in the Magistrate's Court. Must be filed within one month after the 15-day period expires. - Court Process & Possible Sentence

The court examines evidence. If found guilty, the drawer can get up to 2 years' imprisonment, or a fine up to twice the cheque amount, or both. - Interim Compensation (if applicable)

Under Section 143A, the court may direct interim compensation during the pendency of the case.

Key Points / Recent Developments

- The "Checklist for 138 N.I. Matters" is available as a government PDF form for courts to follow procedures.

eCourt India Services - Delhi has implemented digital courts & e-filing for cheque bounce cases to speed up the process.

Press Information Bureau - The Supreme Court has clarified that complaints can be taken only against the drawer of the cheque.

API SCI - The timeframe rules (30-day notice, 15 days to pay, 1 month to file complaint) are mandatory; noncompliance can invalidate the case.

API SCI

FAQs — Cheque Bounce Under Section 138

-

1. What is cheque bounce?

-

Bank refuses payment due to insufficient funds, signature mismatch, closed account, etc.

-

2. Which law covers cheque bounce?

-

Section 138, Negotiable Instruments Act, 1881.

-

3. Civil or criminal?

-

It's a criminal offence, though you may also pursue civil recovery.

-

4. What is the first step after cheque bounce?

-

Get the return memo from the bank.

-

5. When must the legal notice be sent?

-

Within 30 days from the date of the return memo.

-

6. What must the notice contain?

-

Details of cheque, reason for dishonour, demand for payment within 15 days.

-

7. How long does the drawer have to pay?

-

15 days from the receipt of the notice.

-

8. What if payment isn't made?

-

File a complaint within one month of expiry of that 15-day period.

-

9. Can the notice be sent via WhatsApp or email?

-

Better to use Registered Post / Courier with proof of delivery.

-

10. What penalties can be imposed?

-

Imprisonment up to 2 years, or fine up to twice the cheque amount, or both.

-

11. Can I claim interest?

-

Yes, claim interest in your complaint.

-

12. What about a post-dated cheque?

-

If dishonoured and for a legal debt, Section 138 may apply.

-

13. If it was a gift cheque?

-

No—Section 138 applies only to legally enforceable debt or liability, not gifts.

-

14. What if issuer stops payment?

-

Even "stop payment" doesn't protect if it was for a debt.

-

15. Where can I file the case?

-

Typically where the bank branch is located or where the account is maintained.

-

16. Multiple cheques in one complaint?

-

Generally separate cases, unless part of same transaction and allowed by court.

-

17. What if I miss the 30-day notice window?

-

Criminal remedy is lost under Section 138; civil remedies may still be available.

-

18. Can the drawer appeal?

-

Yes, they can challenge conviction or order in higher court.

-

19. Is a lawyer needed?

-

Highly advisable for drafting notice, complaint, and court handling.

-

20. Can a company be prosecuted?

-

Yes. If a company issues the cheque, its officers may also be liable.

Add new comment