Legal Framework & Key Highlights

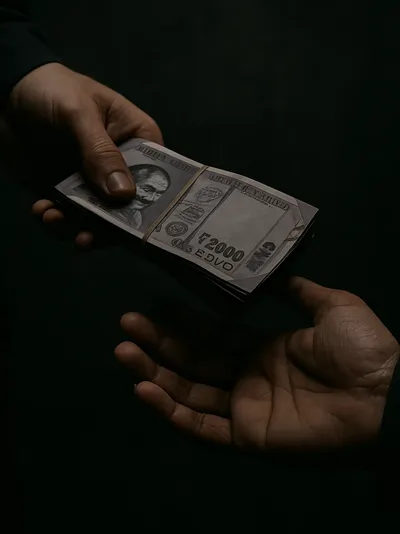

The Prevention of Money Laundering Act (PMLA), 2002, is a key legislation in India aimed at combating money laundering and related crimes. It empowers authorities to confiscate property derived from or involved in money laundering and establishes a legal framework for the enforcement of anti-money laundering measures.

Key Highlights of PMLA, 2002

- Definition of Money Laundering: The Act defines money laundering as the process of concealing the origins of illegally obtained money, typically by means of transfers involving foreign banks or legitimate businesses.

- Enforcement Directorate (ED): The ED is the primary agency responsible for investigating and prosecuting offenses under the PMLA.

- Confiscation of Property: The Act allows for the seizure and confiscation of property derived from or involved in money laundering activities.

- Punishment: Offenses under the PMLA are punishable with imprisonment ranging from three to seven years, and up to ten years for more serious offenses, such as those related to terrorism or narcotics.

- Special Courts: The Act provides for the establishment of special courts to expedite the trial of offenses under the PMLA.

Obligations of Reporting Entities

- Client Due Diligence (CDD): Reporting entities must verify the identity of clients and maintain records of transactions.

- Suspicious Transaction Reporting: Entities must report suspicious transactions to the Financial Intelligence Unit – India (FIU-IND).

- Record Maintenance: Records of transactions must be maintained for a minimum of five years.

Frequently Asked Questions (FAQs)

-

1. What is money laundering?

-

Money laundering is the process of concealing the origins of illegally obtained money, typically by means of transfers involving foreign banks or legitimate businesses.

-

2. Who enforces the PMLA?

-

The Enforcement Directorate (ED) is the primary agency responsible for investigating and prosecuting offenses under the PMLA.

-

3. What are the penalties for money laundering?

-

Offenses under the PMLA are punishable with imprisonment ranging from three to seven years and up to ten years for more serious offenses, such as those related to terrorism or narcotics.

-

4. What is the role of FIU-IND?

-

The Financial Intelligence Unit – India (FIU-IND) is responsible for receiving, processing, and analyzing information related to suspicious financial transactions.

-

5. Which entities are required to comply with PMLA?

-

Entities such as banks, financial institutions, and intermediaries are designated as 'reporting entities' and must comply with the obligations under the PMLA.

-

6. How can one report a suspicious transaction?

-

Suspicious transactions must be reported to the Financial Intelligence Unit – India (FIU-IND) as per the guidelines provided.

-

7. Are there any exemptions under PMLA?

-

Certain transactions may be exempted from reporting requirements, subject to conditions specified by the authorities.

-

8. What is the process for confiscation of property?

-

The Act allows for the seizure and confiscation of property derived from or involved in money laundering activities, following due process of law.

-

9. Can individuals be prosecuted under PMLA?

-

Yes, individuals can be prosecuted under the PMLA if found guilty of money laundering offenses.

-

10. How does PMLA align with international standards?

-

The PMLA is in line with international anti-money laundering standards, including those set by the Financial Action Task Force (FATF).

Add new comment